New Iron County Jail Public Hearing…Part 2

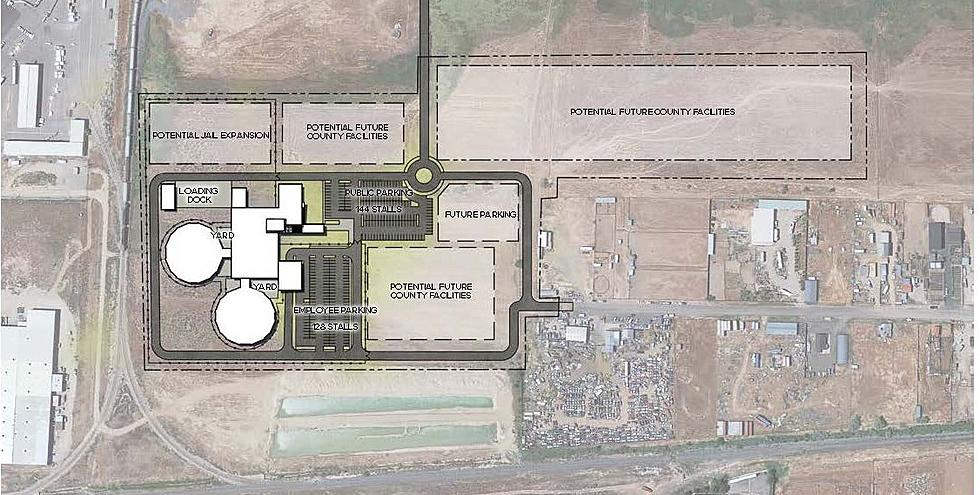

Apparently we have some more talking to do about the proposed new Iron County Sheriff's Complex and Correctional Facility.

The Iron County Board of Commissioners will be holding a second special public meeting on Thursday, August 31st. The meeting will be held in Cedar City at Heritage Theater, 105 North 100 East in Cedar City, at 6:30PM. The purpose of the meeting is to conduct a public hearing concerning a proposed tax increase to the Iron County General Fund.

Commissioners and Iron County staff will present information about the the proposed new jail, along with information about the financing and the possibility of bonding.

And that's the new wrinkle with this meeting. As part of the proceedings on Thursday night, Commissioners will be considering a resolution providing for a special bond election that would be held on November 21st, 2023. If the resolution is passed, voters will have the opportunity to vote on the issuance of general obligation bonds of up to $89.95 million dollars to finance the cost of building the jail and related expenses.

The Iron County School District has already placed an election for the issuance of $75.465 million for the construction of new school facilities. If Iron County Commissioners pass the resolution Thursday to put the jail bonding before the public, both issues would be on the November 21st ballot.

If the budget proposal is approved, the Iron County General Fund would increase its property tax budgeted revenue 99.49% above last years property tax budgeted revenue.

For just the jail bond issue, residential property owners with a home valued at $405,000 would see their property tax increase from $186.44 per year to $371.93, an increase of 185.49 per year or $15.46 per month. Tax on a business property of the same value would increase from $338.99 to $676.25 per year an increase of $327.26 per year or roughly $27.28 per month.

In a truth in taxation release the county maintains two reasons for the need of the tax increase. The first reason is the need to build a new Sheriff's Complex and the second reason is listed as inflation. Due to inflation and rising construction costs, the County will need to increase taxes in order to maintain its current level of services and to be able to pay for the new complex.

The current Sheriff's Complex was built in 1987, and is the oldest operating correctional facility in Utah. The current jail is near capacity, and there have been times when prisoners who have been booked have been turned away due to overcrowding.

There is a reason why counties and local municipalities need to build jail facilities. Jails are short-term holding facilities typically operated at the local level, usually by counties or municipalities. Their primary purpose is to detain individuals who have been arrested and are awaiting trial or arraignment.

According to the truth in taxation information, if Iron County does not borrow money to pay for the remaining portion of the jail, then it will never be able to save up enough money for the project due to the negative effects of inflation. The additional revenue will go towards bond payments, jail operating expenses and general operating expenses of the county.

To get more information on the proposed tax increase, residents can call 435-477-8349 or email clerk.group@ironcounty.net . Residents who are unable to attend the public hearing will be able to stream the meeting at https://www.youtube.com/channel/UCzP7a7p83dJYk9x6Qh-xi3g.

Commissioners have a genuine desire to have the public come and participate by hearing the presentation and welcome public input and comments.